|

The first half of 2020 has been a rollercoaster ride. The COVID-19 pandemic completely altered our way of life and threw the economy into a tailspin. Most states have started the reopening process, but there is still significant uncertainty about the long-term impact of coronavirus and how long the pandemic will continue.

Federal Reserve Chairman Jerome Powell recently said the economy faces a “long road” to recovery, and predicted the process may take through 2022.1 While the recovery may be a long-term journey, there have been some signs of hope in recent months: Stock Market Returns The stock market had been enjoying the longest bull market in history before the coronavirus pandemic hit.2 The bull market came to an abrupt end starting in late February. On February 20, the S&P hit a high of 3373. From that point through March 23, the S&P fell to 2237, a decline of 33.7%.3 However, since that time, the market has increased to 3115 through June 18. That’s an increase of 39.25%. The S&P is nearly back to its pre-COVID levels.3 Of course, it’s impossible to predict the future direction of the markets. Just because the market has been on an upswing doesn’t mean it will continue. A spike in cases or a second round of shutdowns could send the markets back into a decline. Unemployment The pandemic has driven unemployment to record-high levels. Through mid-June, the country had 13 consecutive weeks with more than 1 million new jobless claims. Prior to the coronavirus pandemic, the record for a single week was 695,000 in May 1982.4 The good news is that jobless claims have been declining. At the beginning of the pandemic, weekly jobless claims exceeded 6 million. In fact, up until late-May, they exceeded 2 million. So while jobless claims remain at record highs, they are on the decline. The amount of continuing claims has also dropped from 25 million in early May to just over 20 million in early June.4 Consumer Spending Consumer spending was impacted significantly by the COVID-19 pandemic. That’s not surprising, given most states were effectively shut down for two months. In April, consumer spending dropped by 16.4%, a record monthly decline.5 In May, consumer spending set another record—this time for biggest monthly increase. The figure rose by 17.7%, driven by large increases in clothing (188%), furniture (+90%), sporting goods (+88%), and electronics (+55).5 Consumer spending by itself doesn’t mean the economy is on the path to recovery. There are still plenty of uncertainties in the economy. However, it is a good sign that consumer spending is nearly back to its pre-pandemic levels. This is uncharted territory for all of us. The situation and data changes so fast that it’s impossible to project where the economy may be headed. A comprehensive strategy that aligns with your goals and risk-tolerance can keep you on track to meet your long-term objectives. Let’s connect today and talk about your concerns, questions and challenges. At DSM Financial, we can help you develop and implement a strategy. Contact us today and let’s start the conversation. 1https://www.marketwatch.com/story/fed-sees-rates-near-zero-through-2022-says-asset-purchases-will-continue-2020-06-10 2https://www.cnn.com/2020/03/11/investing/bear-market-stocks-recession/index.html 3https://www.google.com/search?q=INDEXSP:.INX&tbm=fin&stick=H4sIAAAAAAAAAONgecRowi3w8sc9YSntSWtOXmNU5eIKzsgvd80rySypFBLnYoOyeKW4uTj1c_UNDM0qi4t5FrHyePq5uEYEB1jpefpFAAAU6wGESAAAAA#scso=_hL3sXpOQHsnWtAal04OQCA1:0 4https://www.cnbc.com/2020/06/18/weekly-jobless-claims.html 5https://finance.yahoo.com/news/consumer-spending-comes-back-with-a-vengeance-in-may-morning-brief-100600715.html Licensed Insurance Professional. This information is designed to provide a general overview with regard to the subject matter covered and is not state specific. The authors, publisher and host are not providing legal, accounting or specific advice for your situation. By providing your information, you give consent to be contacted about the possible sale of an insurance or annuity product. This information has been provided by a Licensed Insurance Professional and does not necessarily represent the views of the presenting insurance professional. The statements and opinions expressed are those of the author and are subject to change at any time. All information is believed to be from reliable sources; however, presenting insurance professional makes no representation as to its completeness or accuracy. This material has been prepared for informational and educational purposes only. It is not intended to provide, and should not be relied upon for, accounting, legal, tax or investment advice. This information has been provided by a Licensed Insurance Professional and is not sponsored or endorsed by the Social Security Administration or any government agency. 20195 - 2020/6/22

0 Comments

On March 27, the government passed the Coronavirus Aid, Relief, and Economic Security Act, otherwise known as the CARES Act. The Act had a wide range of provisions to provide Americans and small businesses with economic support during the coronavirus pandemic. The bill provided stimulus payments, enhanced unemployment, and various forms of business loans.

One provision that flew under the radar was the ability for qualified individuals to take distributions from their 401(k) plans and IRAs without paying early distributions penalties. Normally, you face a 10% early distribution penalty if you take a withdrawal from these accounts before age 59 ½.1 However, under the CARES Act you can take up to $100,000 as a penalty-free distribution from your qualified accounts, assuming you are a qualified individual.2 Are you qualified? And even if you can take a distribution, is it wise to do so? CARES Act Qualified Plan Distributions Under the CARES Act, you can take up to $100,000 in qualified plan distributions if you are a qualified individual. Who is qualified? Anyone who meets the following criteria:

If you meet any of these criteria and you decide to take a distribution, you won’t have to pay the 10% early distribution penalty, even if you are under age 59 ½. However, you will still have to pay income taxes on the distribution. You can spread the taxes out over a three-year period, but you still have to pay them.2 Should you take a CARES Act distribution? A CARES Act distribution may be the right strategy if you are in a financial crisis and have limited avenues available for relief. However, just because the distribution is “penalty-free” doesn’t mean it comes without consequences. In addition to paying taxes on the distribution, you’ll also forego any future growth on the assets you withdraw. Tax-deferred growth is one of the biggest advantages of a qualified account. However, if you pull out funds, you lose all future tax-deferred growth on that amount. That could lead to a substantial reduction in your future assets at retirement. Instead of dipping into your 401(k) or IRA, consider what other options you may have available. For instance, perhaps you could tighten your budget. Maybe you could refinance mortgages or other loans, or even renegotiate new payment terms. You may even consider picking up additional work until the crisis passes. It may be tempting to take an IRA distribution, but you’re only taking money from your future self. Let’s talk about strategies to help you get through this period. Contact us today at DSM Financial. We can help you analyze your needs and develop a plan. Let’s connect soon and start the conversation. 1https://www.irs.gov/newsroom/what-if-i-withdraw-money-from-my-ira 2https://www.irs.gov/newsroom/coronavirus-related-relief-for-retirement-plans-and-iras-questions-and-answers Licensed Insurance Professional. This information is designed to provide a general overview with regard to the subject matter covered and is not state specific. The authors, publisher and host are not providing legal, accounting or specific advice for your situation. By providing your information, you give consent to be contacted about the possible sale of an insurance or annuity product. This information has been provided by a Licensed Insurance Professional and does not necessarily represent the views of the presenting insurance professional. The statements and opinions expressed are those of the author and are subject to change at any time. All information is believed to be from reliable sources; however, presenting insurance professional makes no representation as to its completeness or accuracy. This material has been prepared for informational and educational purposes only. It is not intended to provide, and should not be relied upon for, accounting, legal, tax or investment advice. This information has been provided by a Licensed Insurance Professional and is not sponsored or endorsed by the Social Security Administration or any government agency. 20100 - 2020/5/20 The economic fallout from the coronavirus pandemic continues, even as states start to reopen restaurants, retail stores, and other businesses. The crisis brought an end to the bull market that started in 2009 and threatens to usher in a recession.1

What does the future hold for the stock market and the economy? When will the economy recover? And how will this crisis impact your retirement and your financial future? It’s impossible to definitively answer those questions. In many ways, this event is unprecedented. We don’t know how long the virus will present a threat, so it’s impossible to predict how or when the economy may recover. However, it is possible to make adjustments to your strategy to minimize risk and take advantage of potential opportunities. It’s also helpful to keep in mind the long-term nature of the economy and the financial markets. Nothing lasts forever, including recessions and bear markets. Stock Market Performance The financial markets have been a rollercoaster since the onset of the pandemic. On February 19, the S&P 500 closed at 3386. On March 23, it closed at 2237, a drop of 33.93%. Since that time, the market S&P has climbed to 2863 as of May 15.2 It’s important to remember that the stock market isn’t the same as the economy. A drop in the stock market doesn’t necessarily signal a recession, just like a rise doesn’t necessarily spell an economic recovery. It’s also helpful to remember that bear markets are a natural part of investing. They aren’t always caused by global pandemics, but they do happen. There have been 16 bear markets since 1926. On average, they last 22 months and are followed by a 47% gain in the year following the market’s lowpoint.3 We can’t predict when the market will hit its low point, or if it already has, but if history is any guide, the market will recover at some point. Economic News While the stock market has bounced back somewhat since its March decline, the overall economic news continues to be negative. More than 36 million people have filed for unemployment since late March. In 11 states, more than a quarter of the workforce is unemployed.4 In the first quarter, the economy contracted for the first time since the 2008 financial crisis. GDP declined by an annualized rate of 4.8%. That’s not as steep as the GDP decline of 8.4% annualized decline in 2008. However, it’s possible the economy could face a greater decline in the second quarter. Consumer spending, which accounts for 70% of GDP, fell by an annualized rate of 7.6% in the first quarter. That’s the steepest drop for that metric since 1980.5 While states may be starting the reopen process, there is still significant uncertainty surrounding the crisis and the economy’s future. The good news is you can take action to minimize risk. Contact us today at DSM Financial. We can help you analyze your goals and needs and implement a strategy. Let’s connect today and start the conversation. 1https://www.cnn.com/2020/03/11/investing/bear-market-stocks-recession/index.html 2https://www.google.com/search?safe=off&tbm=fin&sxsrf=ALeKk01UjyvpIcf62vDAgyulZ3dZuL1GWg:1589832165005&q=INDEXSP:+.INX&stick=H4sIAAAAAAAAAONgecRowi3w8sc9YSntSWtOXmNU5eIKzsgvd80rySypFBLnYoOyeKW4uTj1c_UNDM0qi4t5FrHyevq5uEYEB1gp6Hn6RQAAItD1MEkAAAA&sa=X&ved=2ahUKEwikycWrmr7pAhWWU80KHfhUBrcQlq4CMAB6BAgBEAE&biw=1536&bih=754&dpr=1.25#scso=_JerCXv0o9o70_A-NwLLYBg1:0 3https://www.fidelity.com/viewpoints/market-and-economic-insights/bear-markets-the-business-cycle-explained 4https://www.nytimes.com/2020/05/14/business/economy/coronavirus-unemployment-claims.html 5https://www.npr.org/sections/coronavirus-live-updates/2020/04/29/847468328/tip-of-the-iceberg-economy-likely-shrank-but-worst-to-come Licensed Insurance Professional. This information is designed to provide a general overview with regard to the subject matter covered and is not state specific. The authors, publisher and host are not providing legal, accounting or specific advice for your situation. By providing your information, you give consent to be contacted about the possible sale of an insurance or annuity product. This information has been provided by a Licensed Insurance Professional and does not necessarily represent the views of the presenting insurance professional. The statements and opinions expressed are those of the author and are subject to change at any time. All information is believed to be from reliable sources; however, presenting insurance professional makes no representation as to its completeness or accuracy. This material has been prepared for informational and educational purposes only. It is not intended to provide, and should not be relied upon for, accounting, legal, tax or investment advice. This information has been provided by a Licensed Insurance Professional and is not sponsored or endorsed by the Social Security Administration or any government agency. 20093 - 2020/5/19 Are you one of the more than 58 million Americans who use a 401(k) plan to save for retirement? As of the end of 2019, 401(k) plans held more than $6.2 trillion, which accounts for nearly 20% of all retirement assets in the United States.1

A 401(k) can be an effective savings vehicle for a few reasons. First, all growth is tax deferred. You don’t pay taxes on your gains until you start taking distributions from the account. You also may receive employer contributions, which could significantly increase your savings. While a 401(k) can be an effective savings vehicle, you may need other options in your strategy. In 2020, you can contribute up to $19,500 to a 401(k). That number is increased to $26,000 if you’re age 50 or older.2 If you hit the contribution limit and still want to contribute more money for retirement, you may need to find another vehicle to do so. Below are three savings vehicles that could be good options if you hit the max on your 401(k) this year: Individual Retirement Accounts (IRA) In addition to your 401(k), you can also contribute up to $6,000 to an IRA in 2020. If you are 50 or older, you can contribute an additional $1,000 to an IRA, bringing your total potential contribution to $7,000.3. There are a few different types of IRAs, but the two most popular are the traditional and the Roth. In a traditional IRA, you make upfront contributions that are potentially tax-deductible. Your assets can then grow on a tax-deferred basis, just as they would in a 401(k). All future withdrawals are taxed as income. In a Roth, your contributions aren’t deductible, but your withdrawals in the future are potentially tax-free. Unfortunately, not everyone can contribute to a Roth IRA. If you are single and your income is more than $139,000 or a joint-filing couple with income of more than $206,000, you cannot contribute to a Roth IRA.3 A financial professional can help you determine which type of IRA is right for you. Brokerage Account Another option is to simply open a taxable brokerage account. With these, you don’t get tax-deferred growth, deductible contributions, or any of the other tax benefits you might find with an IRA or a 401(k). However, you do get a great deal of flexibility. In most qualified accounts, you can’t take a withdrawal before age 59 ½ without facing an early-distribution penalty. That’s not the case with a brokerage account. You can take withdrawals anytime you like, which could come in handy if you’re forced to retire early or have a costly emergency. Again, a financial professional can help you determine if this is the right path for you and help you implement an investment strategy. Insurance-Based Vehicles Insurance may not be the first thing that comes to mind when you think about saving for retirement. However, there are insurance-based vehicles that can make effective retirement savings tools. Annuities are insurance-based products that allow you the opportunity for growth while also benefiting from some risk-protection features. Some annuities offer guaranteed* minimum values, so you won’t lose money due to market declines. Others offer guarantees* of future income, so you can protect your cash flow in retirement. Ready to compliment your 401(k) with other savings vehicles? Let’s talk about it. Contact us today at DSM Financial. We can help you develop and implement a strategy. Let’s connect soon and start the conversation. 1https://www.ici.org/faqs/faq/401k/faqs_401k 2https://www.irs.gov/newsroom/401k-contribution-limit-increases-to-19500-for-2020-catch-up-limit-rises-to-6500 3https://www.irs.gov/newsroom/401k-contribution-limit-increases-to-19500-for-2020-catch-up-limit-rises-to-6500 *Guarantees provided by annuities are subject to the financial strength of the issuing insurance company; not guaranteed by any bank or the FDIC. Guaranteed lifetime income available through annuitization or the purchase of an optional lifetime income rider, a benefit for which an annual premium is charged. The information contained herein is based on our understanding of current tax law. The tax and legislative information may be subject to change and different interpretations. We recommend that you seek professional legal advice for applicability to your personal situation. Licensed Insurance Professional. This information is designed to provide a general overview with regard to the subject matter covered and is not state specific. The authors, publisher and host are not providing legal, accounting or specific advice for your situation. By providing your information, you give consent to be contacted about the possible sale of an insurance or annuity product. This information has been provided by a Licensed Insurance Professional and does not necessarily represent the views of the presenting insurance professional. The statements and opinions expressed are those of the author and are subject to change at any time. All information is believed to be from reliable sources; however, presenting insurance professional makes no representation as to its completeness or accuracy. This material has been prepared for informational and educational purposes only. It is not intended to provide, and should not be relied upon for, accounting, legal, tax or investment advice. This information has been provided by a Licensed Insurance Professional and is not sponsored or endorsed by the Social Security Administration or any government agency. 20040 - 2020/4/28 The stock market crash of 1987. The tech bubble in the early-2000s. The financial crisis of 2008. And now, the coronavirus pandemic.

What do all of these things have in common? They all involve sharp market downturns that end a bull market and trigger a bear market. For many investors, these events create anxiety and worry about the long-term ramifications. These events all share something else in common. They offer potential opportunities. In a difficult time like this, it can be hard to see opportunities, but they do exist. Of course, not all opportunities are right for everyone. Your strategy and decisions should be based on your specific needs, goals, and risks. However, it’s possible that you could take action today to improve your financial future. Below are three examples of potential opportunities. A financial professional can help you determine the right course of action for your long-term strategy. Tax-Loss Harvesting If you have seen your portfolio suffer since late February, you are not alone. As recently as early February, we were still enjoying a strong economy. Between Friday, February 21, and Tuesday, March 16, the Dow Jones Industrial Average (DJIA) dropped by 35.87%. Since that low point, the market has recovered somewhat. However, the DJIA is still down 16.4% year-to-date.¹ If you are considering a change in strategy, you also may be able to take advantage of a potential tax deduction. A change in allocation may require you to sell assets that have declined in value. While realizing a loss is never a good outcome, you could qualify for a tax-loss deduction. Of course, this doesn’t mean you should realize losses simply for the tax deduction. Your decision should be guided by your long-term goals. A financial professional can help you determine how best to move forward. Roth IRA Conversion Do you hold a significant amount of retirement assets in a traditional IRA? One of the benefits of a traditional IRA is that you realize an upfront deduction for contributions. However, that also means that your future distributions are taxable as income. You may prefer to use a Roth IRA, which allows you to take tax-free withdrawals in retirement, assuming you are 59 ½ or older, and the account is at least five years old. You can convert your traditional IRA into a Roth, and now could be the time to do so. When you convert a traditional IRA to a Roth, you pay income taxes on the converted amount. If you have seen a decline in your IRA over the past couple of months, you now have a reduced balance. That means the tax exposure from conversion would be lower today than it was two months ago. It’s also possible that, like millions of Americans, you have been laid off, furloughed, or that you have accepted a pay cut. It’s possible that your income for 2020 will be lower than it has been in years past, which means you may be in a lower tax rate. Again, this could reduce your tax exposure in a Roth conversion. Roth conversions aren’t right for everyone. However, if you have been considering one, this may be the right time. Investing at Discounted Prices It’s never a good idea to try and predict the market’s direction, especially in the short-term. Investment decisions should always be guided by long-term strategy and specific goals and needs. However, there is no denying the fact that many assets are currently trading at prices substantially reduced from two months ago. If you have cash available to invest and have the risk tolerance to withstand potential volatility, this could be a good time to revisit your strategy. It’s always wise to hold six to twelve months in liquid, risk-free emergency reserves, even if those accounts pay very little in interest. However, if you have other funds that aren’t needed for emergency reserves, you may want to consider how best to use them in the long-term. Investing at discounted prices may allow you to more fully participate in a future recovery. As always, your decisions should be based on your unique needs, not generalized advice. Let’s talk about it and implement the right strategy for your goals. Contact us today at DSM Financial. We can help you analyze your needs and goals and find the right opportunities. Let’s connect soon and start the conversation. 1https://www.google.com/search?safe=off&tbm=fin&sxsrf=ALeKk006ktaTHRuJ1MB-WYLuWkeqF7PpWw:1588177817109&q=INDEXSP:+.INX&stick=H4sIAAAAAAAAAONgecRowi3w8sc9YSntSWtOXmNU5eIKzsgvd80rySypFBLnYoOyeKW4uTj1c_UNDM0qi4t5FrHyevq5uEYEB1gp6Hn6RQAAItD1MEkAAAA&sa=X&ved=2ahUKEwjPyP-0h47pAhXIWM0KHR3mBUQQlq4CMAB6BAgBEAE&biw=1536&bih=754&dpr=1.25#scso=_N6ypXpKOEYu2tAbp-I-oAQ1:0 Licensed Insurance Professional. This information is designed to provide a general overview with regard to the subject matter covered and is not state specific. The authors, publisher and host are not providing legal, accounting or specific advice for your situation. By providing your information, you give consent to be contacted about the possible sale of an insurance or annuity product. This information has been provided by a Licensed Insurance Professional and does not necessarily represent the views of the presenting insurance professional. The statements and opinions expressed are those of the author and are subject to change at any time. All information is believed to be from reliable sources; however, presenting insurance professional makes no representation as to its completeness or accuracy. This material has been prepared for informational and educational purposes only. It is not intended to provide, and should not be relied upon for, accounting, legal, tax or investment advice. This information has been provided by a Licensed Insurance Professional and is not sponsored or endorsed by the Social Security Administration or any government agency. 20050 - 2020/4/29 On March 27, President Trump signed the Coronavirus Aid, Relief, and Economic Security Act, which provides economic support to Americans who have been impacted by the coronavirus pandemic. You’re probably familiar with the highlights of the bill:

Those components are important and will certainly help many people get through this unprecedented period. However, there are some other provisions that could be important for you, especially if you’re approaching retirement or are already retired. Extended Tax Filing and IRA Deadline The IRS pushed back the tax filing deadline to July 15 from the traditional April 15.2 That gives you more time to prepare your return, collect documents, and possibly implement a strategy to minimize your tax bill. That also gives you more time to contribute to your IRA. You can make an IRA contribution up to July 15 and count it as a deduction on your 2019 return, assuming of course that you meet income requirements.3 401(k) and IRA Distribution Options It’s possible that you may need additional funds to get you through this period, especially if you or your spouse have been furloughed or have lost income. The CARES Act allows you to tap into your qualified retirement accounts through special distributions. You can take a withdrawal from your 401(k) and IRA without paying the 10% early distribution penalty, even if you are under age 59 ½. The distributions are taxable, but the taxes are spread over a three-year period. However, you can also repay the distribution over that three-year period and avoid paying taxes on the distribution.3 While a 401(k) or IRA distribution may be helpful, it could also have long-term consequences. When you take a distribution from your account, those funds are no longer invested. That means those funds can’t compound and grow. It’s possible that you may not fully participate in a market recovery if you decide to take a distribution, which could hurt your long-term growth. Waiver of RMDs Are you required to take an RMD in 2020? Not anymore. The CARES Act waives all RMDs in 2020, so there is no penalty for not taking a minimum distribution from a 401(k) or IRA. 4 This could be very helpful for your account balance. Your RMD would have been based on your December 31, 2019. Depending on how you are allocated, your account value may have been significantly higher on that date than it is today. That means that had the RMD not been waived, you would have potentially been required to take a substantial withdrawal from an account that had fallen in value.4 This may be a confusing and unprecedented time, but you have options available. We are here to help you explore those options and implement a strategy for your retirement needs and goals. Contact us today at DSM Financial. Let’s connect and start the conversation. 1https://www.thebalance.com/2020-stimulus-coronavirus-relief-law-cares-act-4801184 2https://www.irs.gov/coronavirus 3https://www.marketwatch.com/story/this-is-how-the-2-trillion-coronavirus-stimulus-affects-retirees-and-those-who-one-day-hope-to-retire-2020-03-31 4https://www.aarp.org/money/investing/info-2020/cares-act-retiree-tax-benefit.html Licensed Insurance Professional. This information is designed to provide a general overview with regard to the subject matter covered and is not state specific. The authors, publisher and host are not providing legal, accounting or specific advice for your situation. By providing your information, you give consent to be contacted about the possible sale of an insurance or annuity product. This information has been provided by a Licensed Insurance Professional and does not necessarily represent the views of the presenting insurance professional. The statements and opinions expressed are those of the author and are subject to change at any time. All information is believed to be from reliable sources; however, presenting insurance professional makes no representation as to its completeness or accuracy. This material has been prepared for informational and educational purposes only. It is not intended to provide, and should not be relied upon for, accounting, legal, tax or investment advice. This information has been provided by a Licensed Insurance Professional and is not sponsored or endorsed by the Social Security Administration or any government agency. 19977 - 2020/4/7 Do you use a 401(k) or IRA to save for retirement? You’re not alone. These types of accounts are popular for many reasons, but one of the biggest is their tax treatment. As you may know, these accounts are tax-deferred. That means you don’t pay taxes on growth as long as the funds stay inside the account.

Qualified accounts may also offer upfront tax benefits for your contributions. Contributions to your 401(k) come out on a pre-tax basis. That reduces your taxable income, which in turn reduces your taxes. Contributions to an IRA.may also be tax-deductible, depending on your income level. Qualified accounts aren’t completely tax-free, however. While you may get a deduction upfront and taxes may be deferred over time, eventually, you do have to pay taxes on these assets. That time is usually when you take withdrawals in retirement. Most distributions from qualified accounts are taxed as income. That could be problematic if you plan on using your 401(k) or IRA to generate most of your retirement income. You could create high levels of taxable income that may create a significant tax liability, which could reduce your net income and your ability to live a comfortable lifestyle. Fortunately, you can minimize your tax burden by planning ahead. Every situation is unique, so there’s no universal strategy that is right for everyone. However, the following three-step process can help you project your tax liability in retirement and take steps to control it. List all your sources of retirement income. The first step in managing your retirement taxes is to project just exactly where your income will come from. In fact, this isn’t just useful for tax planning; it’s important for your entire retirement strategy. Make a list of all your potential income sources. The list could include things like:

Categorize them by tax treatment. Once you have your list, you can start to categorize your income sources according to how they are taxed. Some income sources will likely be taxable, like:

Other types of income may be tax-free, such as:

And finally, there could be some sources of income that simply require more research. They may be taxable, but also may not be. It could depend on your total taxable income or perhaps other factors. These types of income could include:

Meet with a professional and develop a tax strategy. The final step is to work with a professional to create a detailed projection of your potential income and tax liability in retirement. They can estimate your income and your possible taxes each year. They can then work with you to develop a strategy that minimizes tax payments. For example, they might recommend the use of tax-free income from municipal bonds or a Roth IRA. They could suggest the use of life insurance to create tax-free income. They may recommend that you delay Social Security or choose a different pension benefit to reduce your taxable income. A financial professional can help you find the strategy that is best for your needs. Ready to develop your retirement tax strategy? Let’s talk about it. Contact us at DSM Financial. We can help you analyze your needs and develop a strategy. Let’s connect soon and start the conversation. Licensed Insurance Professional. This information is designed to provide a general overview with regard to the subject matter covered and is not state specific. The authors, publisher and host are not providing legal, accounting or specific advice for your situation. By providing your information, you give consent to be contacted about the possible sale of an insurance or annuity product. This information has been provided by a Licensed Insurance Professional and does not necessarily represent the views of the presenting insurance professional. The statements and opinions expressed are those of the author and are subject to change at any time. All information is believed to be from reliable sources; however, presenting insurance professional makes no representation as to its completeness or accuracy. This material has been prepared for informational and educational purposes only. It is not intended to provide, and should not be relied upon for, accounting, legal, tax or investment advice. This information has been provided by a Licensed Insurance Professional and is not sponsored or endorsed by the Social Security Administration or any government agency. 19662 - 2020/1/16 It’s been a volatile few weeks in the financial markets. Up until late January, we were still enjoying the longest bull market in history. In three short weeks, the bull market has ended, and we’ve entered bear market territory. Between Friday, February 21 and Monday, March 16, the Dow Jones Industrial Average has dropped by 30.37%.1

The rapid decline has left many investors with two questions:

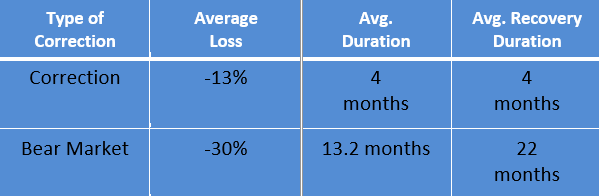

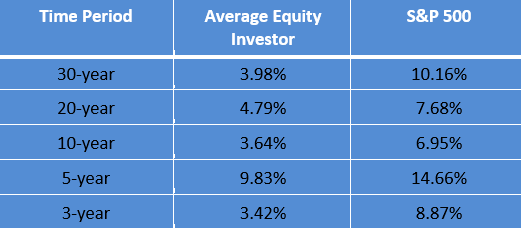

There’s no easy answer to the first question. If history is any guide, eventually the decline will stop, and the markets will recover. The average bear market lasts 13 months, followed by a 22-month recovery.2 However, it’s impossible to predict when that recovery might begin. The second question is even more difficult to answer. There are certainly protection options available, but not all options are right for all investors. Your strategy should be based on your unique needs, goals, and tolerance for risk. Below are a few options you have available: Shifting to a more conservative allocation. Changing your allocation to a more conservative strategy is always an option. Many people become more risk averse as they approach retirement. If you haven’t reviewed your allocation in years, this may be the right time to do so. Of course, a more conservative allocation could limit your participation in a recovery when it happens. Work with a financial professional to find an allocation that limits your exposure to further losses, but still gives you an opportunity to participate future upside. Staying the course. Another option is to stay the course and stay invested in your current allocation. Again, that may expose you to further losses, but it could also put you in a position to take advantage of a recovery when it does happen. Again, it’s impossible to predict when a recovery could happen, but history can provide some insight. The last bear market started in October 2007 and lasted until March 2009, spanning much of the financial crisis. The S&P 500 dropped 56.8%. However, the subsequent bull market (which just ended) lasted more than 10 years and saw the S&P 500 increase by more than 400%.3 The 2000 bear market was triggered by the tech bubble. It lasted nearly 30 months and saw a total decline of more than 49%. It was followed by a 60-month bull market with a return of more than 100%. The 1990 bear market lasted only three months and had a decline of 20% and it was followed by a 113-month bull market with a cumulative return of 417%.3 Bear markets are often followed by bull markets. The question is whether you can stick it out through further losses. Again, your financial professional can talk through your options with you and help you decide which path is right. Use risk-protection vehicles. Another option is to take advantage of market risk-protection vehicles like annuities. There is a wide range of different types of annuities that can limit your exposure to market risk and protect your future. For example, some guarantee your principal against loss, but also offer upside growth potential. Others guarantee your future retirement income, no matter how the market performs in the future. A financial professional can help you determine if an annuity or other risk-protection tool is right for you. Ready to protect your nest egg from the coronavirus? Let’s talk about it. Contact us today at DSM Financial. We can help you analyze your investments and implement a strategy. Let’s connect soon and start the conversation. 1https://www.google.com/search?safe=off&sa=X&tbm=fin&sxsrf=ALeKk02Fk2yPH2_A7nU0wQGE5IUIixHyGQ:1584394531365&q=INDEXDJX:+.DJI&stick=H4sIAAAAAAAAAONgecRozC3w8sc9YSmtSWtOXmNU4eIKzsgvd80rySypFBLjYoOyeKS4uDj0c_UNkgsry3kWsfJ5-rm4Rrh4RVgp6Ll4eQIAqJT5uUkAAAA&ved=2ahUKEwiBmOfJ-Z_oAhWUW80KHc2dA3MQ3N8BMAJ6BAgCEAM#scso=_SfFvXsWJMJe1tAbX6pm4BQ1:0 27https://www.cnbc.com/2018/12/24/whats-a-bear-market-and-how-long-do-they-usually-last-.html 3https://www.cnbc.com/2020/03/14/a-look-at-bear-and-bull-markets-through-history.html Licensed Insurance Professional. This information is designed to provide a general overview with regard to the subject matter covered and is not state specific. The authors, publisher and host are not providing legal, accounting or specific advice for your situation. By providing your information, you give consent to be contacted about the possible sale of an insurance or annuity product. This information has been provided by a Licensed Insurance Professional and does not necessarily represent the views of the presenting insurance professional. The statements and opinions expressed are those of the author and are subject to change at any time. All information is believed to be from reliable sources; however, presenting insurance professional makes no representation as to its completeness or accuracy. This material has been prepared for informational and educational purposes only. It is not intended to provide, and should not be relied upon for, accounting, legal, tax or investment advice. This information has been provided by a Licensed Insurance Professional and is not sponsored or endorsed by the Social Security Administration or any government agency. 19926 - 2020/3/17 The 2020 election cycle is in full swing. It’s primary season, which means the general election is right around the corner. Before you know it, the two major parties will have their conventions and we’ll be heading to the ballot box. Of course, you may already have election fatigue. From the local level all the way up to national races, candidates are already flooding television with political ads. As is the case in most presidential elections, candidates are also talking about the economy. They may make claims about what will happen in the economy if they’re elected or that the markets might decline if their opponent is elected. That kind of rhetoric is common during elections, but is it accurate? Will the outcome of the election impact your portfolio? Should you worry about the election? Or perhaps even change your allocation to protect yourself. Below are a few tips to keep in mind through the rest of the election year: Keep history in perspective. Often when there is one issue or story dominating the news, like the presidential election, it’s easy to focus solely on that story. It’s in the news and on social media so much that it feels like it’s the most important issue in the world. However, the truth is that this country and the stock market have been through many presidential elections. In fact, in most of those years, the markets performed positively. In fact, since 1928, there have been 23 presidential elections. In 19 of those years, the S&P 500 had a positive return.1 In fact, in the four instances when the markets did have negative returns, there were also economic events happening that may have driven the performance. In 1932, the country was in the midst of the Great Depression. In 1940, the country was entering World War II. The markets declined in 2000, which was the year George W. Bush ran against Al Gore. However, the bursting tech bubble in Silicon Valley may have had more influence on the markets than the election. Finally, in 2008, the S&P 500 also declined, but that was the year of the financial crisis. The takeaway is that market declines can happen in any year. The fact that it’s an election year may cause news stories and rhetoric, but the market is likely driven by investor concerns and economic conditions. Focus on the long-term. Your investment strategy was likely designed for the long-term. Perhaps you’re saving for retirement or some other goal that is years or possibly even decades in the future. Over that period, you’ll likely see times of market volatility. Whether it’s an election year or not, it’s always helpful to focus on the long-term during challenging periods. Market downturns happen, but they are always temporary. There are two common types of downturns: corrections and bear markets. Corrections are losses of 10% or more. Bear markets are losses of 20% or more. As you can see in the chart below, the average correction loses around 13% and the average bear market sees a loss of around 30%.2 However, the duration of each is also important. A correction, on average, lasts around four months. After that period, there is an average four-month recovery period to recoup the losses. Bear markets last longer. They have an average duration of 13 months with a 22-month recovery period.2 Market downturns are never pleasant, but they are temporary. Keep an eye on the long-term and stick to your strategy. Don’t make gut decisions. It can be easy to make a gut, impulse decision when you hear and see stressful news on a regular basis. It might be tempting to sell your investments and move to asset classes that have less risk and volatility. However, a move to perceived safety could do more harm than good. The chart below shows how the average equity investor has fared compared the S&P 500 over different periods of time. As you can see, the index always wins, sometimes by a wide margin. 3 Why does this happen? Primarily because the index stays invested at all times, while the average investor is constantly moving in and out of the market based on gut decisions or attempts to avoid loss. While investors may miss some declines with this strategy, they also miss out on gains. Staying invested usually leads to better long-term performance.

Ready to protect your portfolio this election year? Let’s talk about it. Contact us at DSM Financial. We can help you analyze your needs and develop a strategy. Let’s connect soon and start the conversation. 1https://www.thebalance.com/presidential-elections-and-stock-market-returns-2388526 2https://www.cnbc.com/2018/12/24/whats-a-bear-market-and-how-long-do-they-usually-last-.html] 3https://www.marketwatch.com/story/americans-are-still-terrible-at-investing-annual-study-once-again-shows-2017-10-19 Licensed Insurance Professional. This information is designed to provide a general overview with regard to the subject matter covered and is not state specific. The authors, publisher and host are not providing legal, accounting or specific advice for your situation. By providing your information, you give consent to be contacted about the possible sale of an insurance or annuity product. This information has been provided by a Licensed Insurance Professional and does not necessarily represent the views of the presenting insurance professional. The statements and opinions expressed are those of the author and are subject to change at any time. All information is believed to be from reliable sources; however, presenting insurance professional makes no representation as to its completeness or accuracy. This material has been prepared for informational and educational purposes only. It is not intended to provide, and should not be relied upon for, accounting, legal, tax or investment advice. This information has been provided by a Licensed Insurance Professional and is not sponsored or endorsed by the Social Security Administration or any government agency. It’s that time of year again. Time to buy gifts for spouses, children, and all the other friends and family who play a meaningful role in your life. Have you finished your Christmas shopping?

If you’re approaching retirement, you may want to give yourself a gift this year. No, not an expensive gadget or vacation. Rather, use this holiday season to give yourself the gift of a financially stable retirement. The new year will be here before you know it. Take some time now to review your retirement strategy so you can take action and start 2020 on the right foot. Below are a few tips to get you started: Increase your retirement contributions. Do you make retirement contributions to a 401(k), IRA, or another qualified retirement plan? These types of accounts are powerful retirement savings tools because of their tax-deferred status. You don’t pay taxes on growth as long as the funds stay inside the account. That may help your qualified savings compound at a faster rate than they would in a taxable account. Consider increasing your contributions to your 401(k) or IRA in 2020. You can contribute up to $19,500 to a 401(k) in 2020. That number increases to $25,500 if you are age 50 or older. You can also contribute up to $6,000 to an IRA, or up to $7,000 if you are 50 or older.1 Of course, it may not possible for you to increase your contribution to the maximum level without busting your budget. Any increase in contributions is helpful. One effective strategy is to gradually increase your contributions over time. For example, you could set up your 401(k) contribution to increase 1% every year or even every six months. Reduce your exposure to risk.If you’re like many people nearing retirement, you’re not as comfortable with risk as you once were. That’s natural. Many people become more risk-averse as they approach retirement. After all, you don’t have as much time as you once did to recover from a market loss. There are a few steps you can take to reduce your exposure to risk. One is to review your allocation and risk tolerance and make sure they’re aligned. Your risk tolerance is your specific comfort level with market volatility. It’s based on your unique needs, goals, and time horizon. As you get older, your risk tolerance may change, so it’s important that your strategy changes along with it. You could shift your strategy to more conservative assets that have less exposure to risk and volatility. You could also utilize financial vehicles that offer growth potential without the chance of downside loss. A financial professional can help you identify strategies that can reduce your risk exposure. Guarantee* your retirement income. Are you approaching retirement? If so, this may be the time to start thinking about your retirement income. You’ll likely receive income from Social Security. Maybe you’ll even receive a defined benefit pension. However, you also may need to take distributions from your 401(k), IRA, or other retirement savings. Often those withdrawals aren’t guaranteed. A market downturn could limit your ability to take retirement income. Or if you withdraw too much in the early years of retirement, you may not have assets left in the later years. Fortunately, you minimize these risks by creating guaranteed* income from your retirement savings. There is a wide range of retirement vehicles available that you can use to convert a portion of your retirement savings into income that is guaranteed* for life, regardless of what happens in the market or how long you live. Ready to give yourself the gift of financial stability? Let’s talk about it. Contact us today at DSM Financial. We can help you implement a strategy. Let’s connect soon and start the conversation. 1https://www.irs.gov/newsroom/401k-contribution-limit-increases-to-19500-for-2020-catch-up-limit-rises-to-6500 *Guarantees provided by annuities, including optional benefits, are backed by the claims-paying ability of the issuer, and may contain limitations, including surrender charges, which may affect policy values Licensed Insurance Professional. This information is designed to provide a general overview with regard to the subject matter covered and is not state specific. The authors, publisher and host are not providing legal, accounting or specific advice for your situation. By providing your information, you give consent to be contacted about the possible sale of an insurance or annuity product. This information has been provided by a Licensed Insurance Professional and does not necessarily represent the views of the presenting insurance professional. The statements and opinions expressed are those of the author and are subject to change at any time. All information is believed to be from reliable sources; however, presenting insurance professional makes no representation as to its completeness or accuracy. This material has been prepared for informational and educational purposes only. It is not intended to provide, and should not be relied upon for, accounting, legal, tax or investment advice. This information has been provided by a Licensed Insurance Professional and is not sponsored or endorsed by the Social Security Administration or any government agency. 19524 - 2019/12/3 |

Archives

July 2020

Categories

All

|

Mike Moller

DSM Financial

DSM Financial

3309 109th Street

Urbandale, IA 50322

Urbandale, IA 50322

515.331.1717

[email protected]

[email protected]

Advisory Services offered through Change Path LLC an Investment Advisor. DSM Financial and Change Path LLC are not affiliated. 17283 - 2018/1/17

Licensed Insurance Professional. Respond and learn how insurance and annuities can positively impact your retirement. This material has been provided by a licensed insurance professional for informational and educational purposes only and is not endorsed or affiliated with the Social Security Administration or any government agency.

Licensed Insurance Professional. Respond and learn how insurance and annuities can positively impact your retirement. This material has been provided by a licensed insurance professional for informational and educational purposes only and is not endorsed or affiliated with the Social Security Administration or any government agency.

RSS Feed

RSS Feed